Coin Highlight: Ethereum

10 minutes

10 minutes

10 minutes

10 minutes

Ethereum has emerged as a groundbreaking cryptocurrency and blockchain platform poised to reshape the industry in numerous ways.

While Ethereum remains a work in progress, its potential to transform various industries like finance, gaming, and even the internet itself is substantial. Thus, delving into Ethereum and exploring its potential applications becomes crucial.

Let's delve into comprehending what Ethereum truly is.

Ethereum is a decentralised, open source blockchain network that enables developers to create & deploy smart contracts and Dapps without intermediaries.

Its native token, ETH, now ranks as the second-largest cryptocurrency in the world by market capitalisation. Ethereum’s market cap is above $350 trillion with 445214 daily active addresses. The cryptocurrency does not boast a limited number of tokens, and there have been 120,156,542 ETH in circulating supply.

Vitalik Buterin, a Canadian computer programmer, created Ethereum in 2013. Later, Buterin was awarded a Thiel Fellowship to dedicate his efforts entirely to Ethereum. He then established a non-profit to help launch the project, eventually known as the Ethereum Foundation. In early 2014, the Ethereum Foundation conducted an online crowd sale, selling 72 million ETH tokens and amassing around $18 million in funding.

Here is a brief introduction to the Ethereum technical milestones:

Ethereum co-founder Vitalik Buterin also released the Ethereum Network 2024 Roadmap with significant upgrades anticipated, focusing on six main components – the Merge, the Scourge, the Verge, the Purge, and the Splurge. All of which we will cover in more detail.

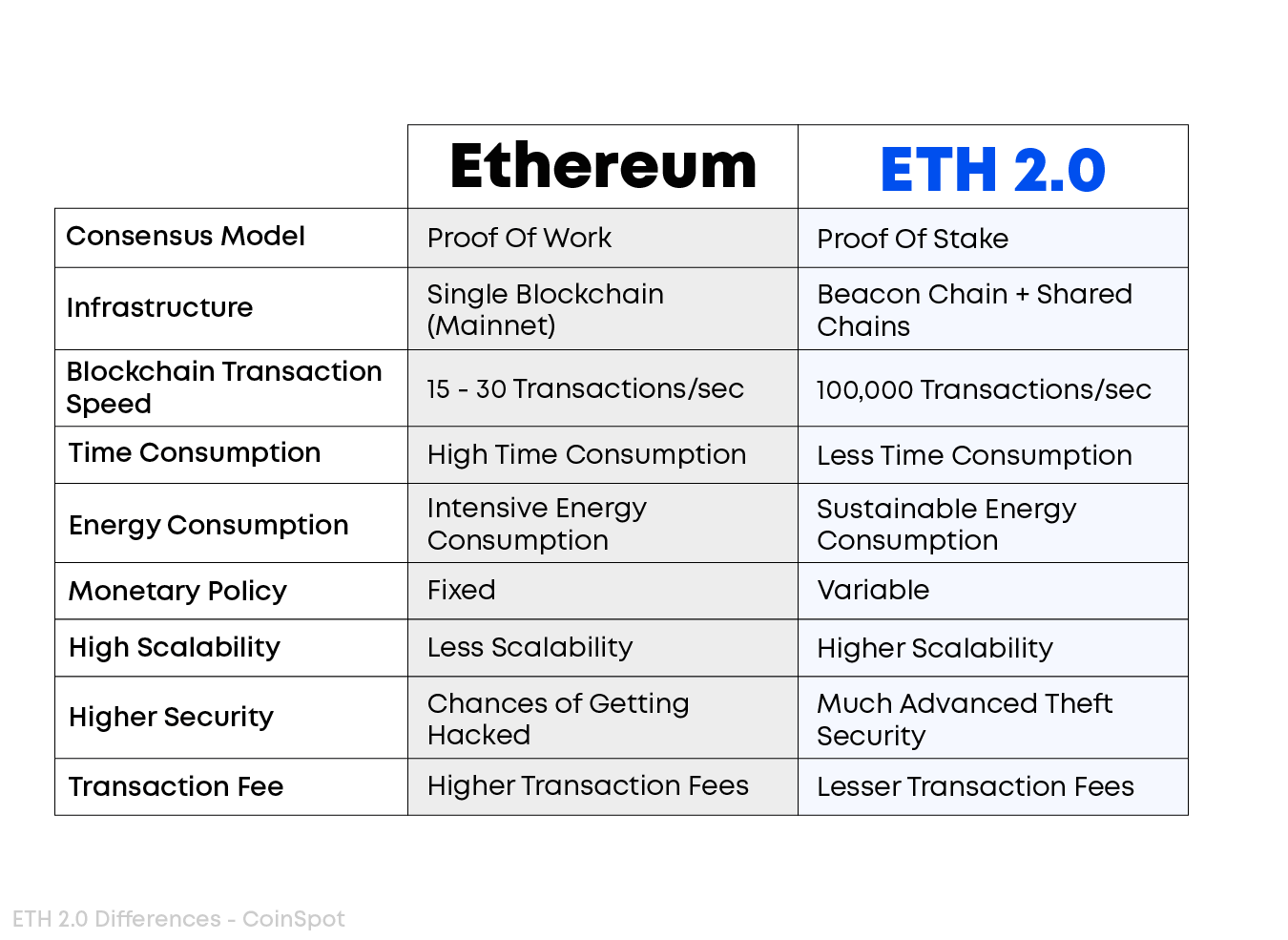

Blockchain is the cornerstone of Ethereum's functionality, operating as a decentralised and immutable ledger distributed across a network of computers known as nodes. Transactions and data are recorded on this ledger, with cryptographic hashes linking them for security and integrity. Ethereum's blockchain, not controlled by any central authority, fosters trustless and transparent interactions among participants, eliminating the need for intermediaries. The transition from a proof-of-work to a proof-of-stake mechanism, known as "The Merge," in September 2022 significantly reduced energy consumption and paved the way for scalability improvements.

Nodes, comprising a distributed network of computers, are pivotal in powering Ethereum's blockchain. They store transaction history, verify transactions, and execute smart contracts, ensuring network security. With over 6.1 million nodes globally, Ethereum's decentralised nature makes it challenging to control a majority of the network, thwarting potential attacks. Validator nodes, or stakers, play a crucial role by locking away ETH for transaction verification. As the network expands, the cost of gaining majority control increases, reinforced by an automated penalty system called "slashing" to deter malicious activities.

The Ethereum Virtual Machine (EVM) acts as a decentralised computing system within the Ethereum blockchain. It provides the environment for Ethereum accounts and smart contracts to operate. As the blockchain progresses, the EVM regulates the computation process, ensuring the creation of a new valid state at each block.

Being Turing-complete, the EVM can execute any program given enough gas to cover the computational expenses, enabling a broad range of applications on the Ethereum platform due to its flexibility.

Additionally, the EVM ensures the deterministic execution of smart contracts, meaning that for a given input and state, the outcome remains consistent. This characteristic is crucial for achieving consensus within the Ethereum network.

Smart contracts are self-executing agreements embedded on the blockchain, comprising lines of code that activate under specific conditions. Their execution upon trigger renders Ethereum highly adaptable in its capabilities. These programs act as building blocks for decentralised apps and organisations. Since smart contracts are automated, they do not discriminate against any user and are always ready to use.

Smart contracts are processed on the EVM, and deploying a smart contract on the Ethereum blockchain requires the user to spend ETH as gas fees to interact with the Ethereum blockchain.

Once deployed, smart contracts are immutable and final, and transactions sent to smart contracts are also irreversible.

Popular examples of smart contracts are lending apps, decentralised trading exchanges, insurance, quadratic funding, social networks, NFTs - basically anything you can think of.

Ether is used as a fee payment for activities on the Ethereum blockchain (e.g., to exchange data or validate transactions). Commonly, these fees are referred to as gas fees – the transaction costs for using the Ethereum network. They’re paid to compensate the network’s validators for participating in the processing and validating of transactions on the network.

The smallest ETH unit is called a wei. One wei is 10^-9 ETH. Another ETH unit is gwei. One gwei is equal to 1 billionth of an ETH, and it is used more frequently when talking about gas fees. For instance, if the gas fee is 100 gwei, it costs 0.0000001 ETH to execute a transaction.

You can use other cryptocurrencies to get Ether tokens, but vice versa is impossible. This means that ETH cannot be interchanged by other cryptocurrencies to render computing power for Ethereum transactions.

A blockchain node is a computer that participates in the blockchain network by maintaining a copy of the blockchain ledger and verifying transactions.

There are 3 different types of nodes on the Ethereum blockchain, depending on the node runner’s goals, computing power, and hardware storage availability:

If you want to start running a node on Ethereum, there is no need for holding ETH. Plausible instruction is provided on the Ethereum website.

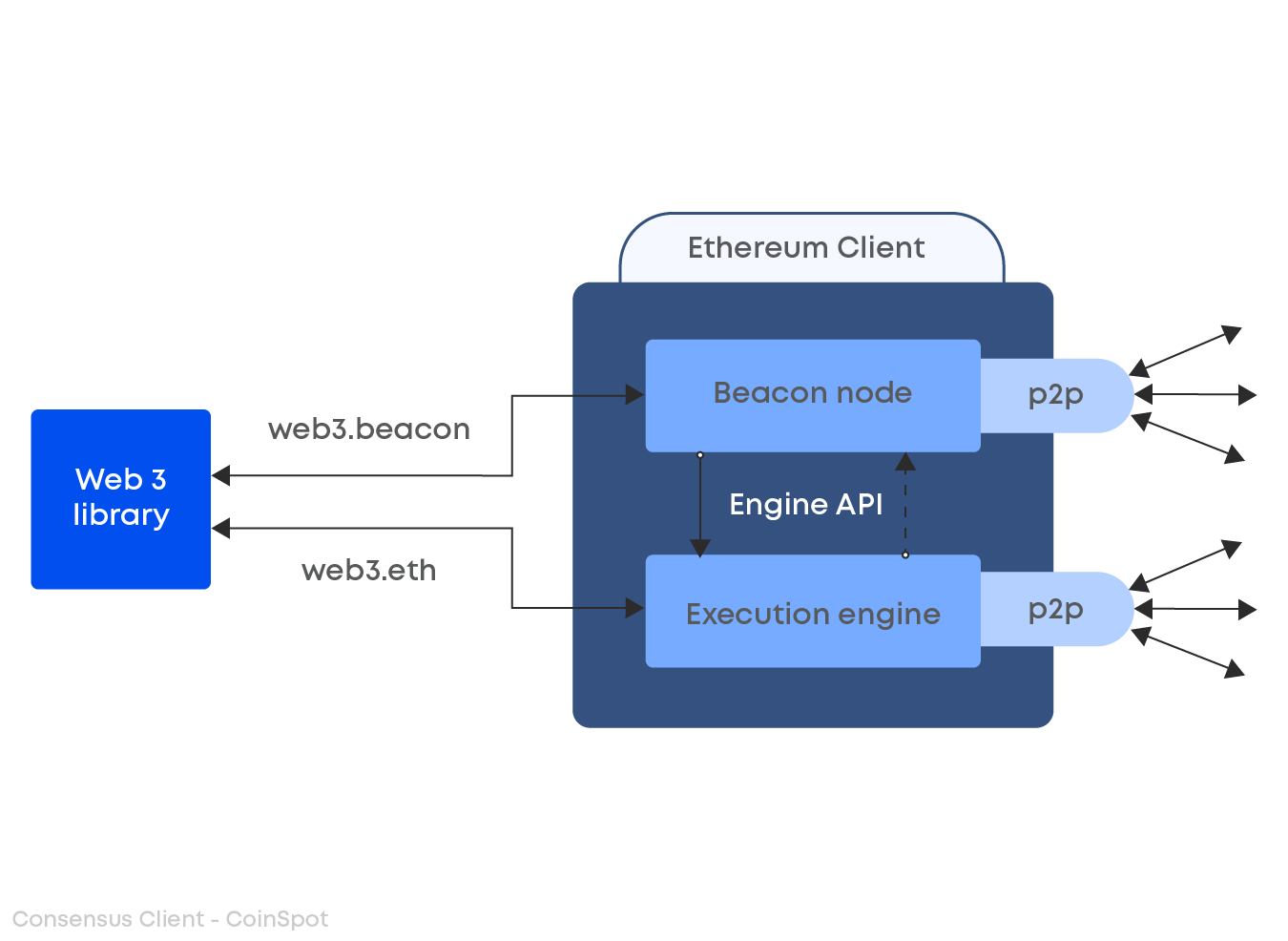

Clients run as an integral component responsible for validating data according to the protocol’s rules in the Ethereum ecosystem. Two normally deployed sorts of clients are:

Simplified diagram of a coupled execution and consensus client. Source: Ethereum

Ethereum accounts come in two forms – the externally owned account (EOA) and the contract account.

An EOA account enables users to store, receive, and send ETH or tokens built on the Ethereum blockchain (e.g., ERC-20 tokens). This account is manipulated by a private key, meaning that anyone who possesses the key can access the account and its assets.

Ethereum contract accounts, however, are controlled by smart contracts and cost ETH to set up.

The key difference between the two kinds of accounts lies in their interaction capabilities. External Owned Accounts (EOAs) can engage with both other EOAs and smart contracts. Meanwhile, Contract Accounts can also communicate with EOAs and other contracts but rely on smart contracts to operate.

Ethereum Token Standards encompass a set of rules and protocols established within the Ethereum blockchain framework. They govern the management and represent diverse types of assets, including points, currencies, digital assets, and others, in tokenised form. These standards guarantee interoperability among various applications and services leveraging tokens within the same blockchain network.

The realm of payment gateways has witnessed some of Ethereum's earliest and most renowned implementations. Ether (ETH), Ethereum's native currency, serves dual purposes of value storage and facilitating decentralised transactions.

Through trustless payment gateways built on Ethereum, individuals and businesses can conduct transactions without relying on traditional intermediaries like banks. This has led to faster international transactions, reduced fees, and increased financial inclusion, particularly in areas with limited access to traditional banking services.

Entrepreneurs have leveraged Initial Coin Offerings (ICOs) on the Ethereum blockchain to raise capital in innovative ways by issuing their digital tokens. ICOs enable businesses to access global pools of investors without the need for traditional venture capital firms.

While ICOs initially offered a groundbreaking approach to fundraising, they have faced regulatory hurdles and evolved into more regulated forms such as Security Token Offerings (STOs) or Initial Exchange Offerings (IEOs).

Ethereum's ability to create fungible and non-fungible tokens has facilitated the tokenisation of physical assets such as real estate and artwork. This process enables fractional ownership, improves liquidity, and streamlines ownership transfers. Investors can now diversify their portfolios by purchasing fractions of high-value assets, democratising access to wealth previously reserved for the affluent.

Blockchain technologies like Ethereum have the potential to revolutionise the healthcare sector. Ethereum-based applications can enhance patient privacy and facilitate interoperability among healthcare providers by providing a secure and immutable ledger for health data. This could lead to more comprehensive medical records, fewer errors, and enhanced research opportunities.

Ethereum's self-sovereign identification concept empowers individuals to own and manage their data without relying on centralised authorities. Secure and verifiable identity verification is made possible through decentralised identifiers (DIDs) and verifiable credentials. This has applications ranging from simplifying KYC procedures for financial services to enhancing online authentication and access management.

These above implications represent just a few examples of how Ethereum is revolutionising industries and driving the adoption of decentralised technologies. As Ethereum continues to evolve, its impact across various sectors is expected to grow, presenting both new opportunities and challenges along the way.

Staking on the Ethereum blockchain is integral to its consensus mechanism, particularly the Proof-of-Stake (PoS) model, which Ethereum adopted after the Ethereum Merge. Unlike the Proof-of-Work (PoW) model where miners solve complex puzzles to validate transactions, PoS selects validators based on the amount of cryptocurrency they commit to "stake" or lock up.

However, not everyone possesses enough ETH to stake or wants to manage their validating node due to technical complexities. Consequently, staking pools and services have emerged, enabling users to pool their ETH together, meet the staking threshold, and collectively share in the rewards.

Scalable solutions are geared towards enhancing transaction speed on a network, employing diverse methods to expedite transaction processing, notably layer 2 rollups and sidechains. Here are some innovative solutions currently in use or under development:

Rollups function independently to manage tasks and leverage Ethereum for additional security checks, blending efficiency with Ethereum's safety features.

Plasma chains offer a scaling alternative utilising fraud-proofing techniques akin to optimistic rollups but maintaining data accessibility off-chain, distinct from optimistic rollups.

State channels enable secure off-chain transactions with minimal interaction on the Ethereum Mainnet. Users can conduct numerous off-chain transactions, requiring only two on-chain transactions to initiate and terminate the channel, ensuring rapidity and cost-effectiveness.

Sidechains are autonomous blockchains linked to the Ethereum Mainnet via a bridge, facilitating expedited transaction processing. Unlike layer 2 solutions, they do not relay data back to the Ethereum Mainnet.

The primary objective of Ethereum's core developers has always been to introduce the protocol in multiple phases. Given Ethereum's intricate nature and its ability to sustain a wide array of applications, it necessitates meticulous development to ensure security, scalability, and decentralisation. Phased launches enable developers to thoroughly test each aspect of the protocol in real-world scenarios.

These Ethereum phases include:

The initial three upgrades, Frontier, Homestead, and Metropolis, collectively form "Ethereum 1.0," while Serenity represents "Ethereum 2.0" or what is now referred to as the Consensus Layer. Let's delve further into these significant milestones of Ethereum.

As previously described in the Ethereum Journey: A brief of milestones section, all these milestones in Ethereum 1.0 and Ethereum 2.0 have already been discussed. Therefore, this section will only guide you through the main phases of Ethereum 1.0 and Ethereum 2.0.

Ethereum is a platform enabling the creation of secure digital technologies. Its native cryptocurrency, Ether (ETH), serves to pay for supporting blockchain work, and it can also be utilised for purchasing tangible goods and services if accepted by the seller.

Ethereum's popularity stems from its programmable blockchain, distinguishing it from Bitcoin. This feature allows users to develop and operate new tools, applications, DeFi, smart contracts, and NFTs within its software network.

Ethereum's flexibility and scalability make it increasingly popular among large institutions. While Bitcoin is often likened to "digital gold," Ethereum, with its broader range of practical applications, is considered more akin to "digital oil." Over the long term, Ethereum is expected to become the more valuable cryptocurrency due to its expanding practical use cases.

Ethereum differs from Bitcoin as it was designed not just as a currency but as a decentralised computing platform. This platform enables developers to construct and deploy decentralised applications, including smart contracts, using blockchain technology.

Ether is Ethereum's native cryptocurrency, utilised for paying transaction fees and computational services on the network. It is also tradable on cryptocurrency exchanges like other digital currencies.

A smart contract is an automatic computer program enforcing agreement rules between parties on the Ethereum blockchain without the need for intermediaries.

Gas is a fee paid in Ether to compensate miners for processing transactions and running smart contracts on the Ethereum network.

The EVM is a software environment where smart contracts execute on the Ethereum network.

The future of Ethereum appears promising, with decentralised finance and limitless possibilities, shining brighter than the moon on a cloudless night.