Market Update

Ethereum Tops Bitcoin In Corporate Treasury Race

3 minutes

3 minutes

3 minutes

3 minutes

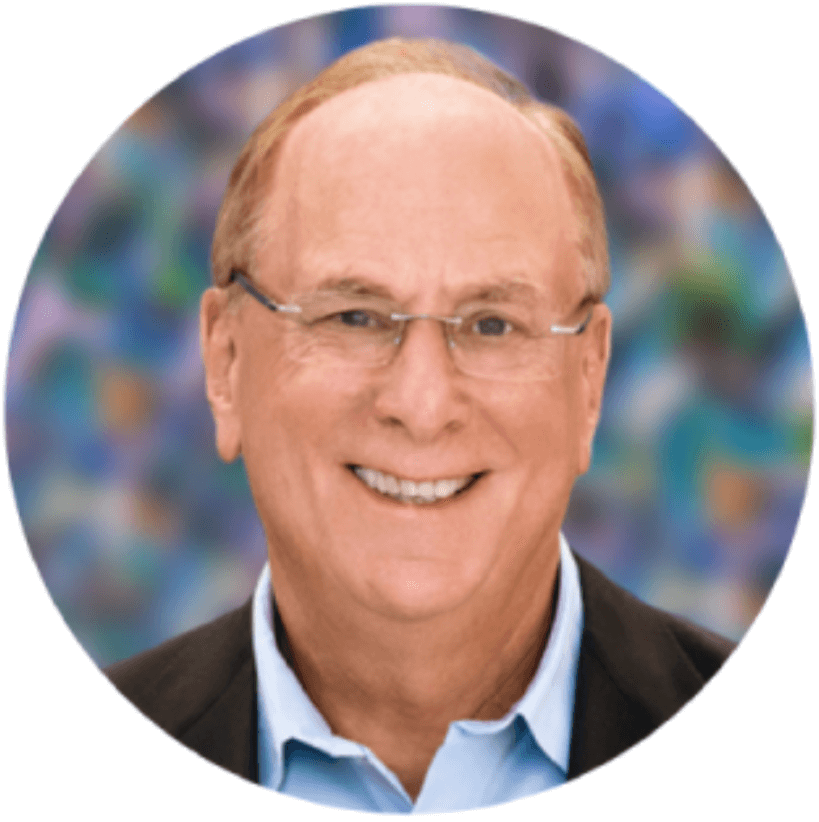

Larry Fink, the CEO of BlackRock, the world’s largest asset manager, continues to warm to Bitcoin as a legitimate asset that may serve as an international hedge against economic and political instability. Appearing on CBS’s 60 Minutes earlier this week, Fink shared his view that Bitcoin can play a similar role to gold as a portfolio diversifier.

It follows similar comments made by Fink earlier this year, when the BlackRock CEO said he is a “big believer” in Bitcoin, describing its potential value as an international hedge against economic and political instability. The comments mark a stark reversal from Fink’s opinion on Bitcoin in 2017, when he described it as "an index of money laundering."

BitMine Technologies, the digital asset firm led by Tom Lee, continued its aggressive accumulation of Ethereum (ETH), adding over 200,000 ETH in recent days for a cost of approximately $1.2B ($800M USD). The latest acquisition came during ETH’s latest pullback, signalling BitMine’s commitment to its long-term treasury strategy.

Following this purchase, BitMine’s total holdings have risen to more than 3 million ETH, equating to over 2.5% of ETH’s total supply. The firm has publicly stated its goal of acquiring 5% of the circulating supply, meaning it is now halfway to that target.

Total ETH held by BitMine since mid-July (Source: Strategic ETH Reserve)

BitMine’s heavy buying of ETH has helped ETH surpass BTC in terms of the percentage of total supply held by treasury companies. According to data from Blockworks, 3.93% of ETH’s supply is now held by treasury companies such as BitMine, SharpLink and The Ether Machine. This compares to 3.49% for BTC.

As the chart below shows, the growth of ETH supply held by treasury companies has been particularly strong. It was only four months ago when only 0.03% of ETH’s supply was held by these types of organisations.

The combined market cap of all stablecoins has continued to trend higher, surpassing $460B ($300B USD) for the first time, indicating that more capital is coming ‘on-chain’ and being used across the crypto ecosystem for reasons such as payments, settlement, saving and lending.

Tether (USDT) and USDC (USDC) continue to be the two largest stablecoins, accounting for more than 80% of the overall stablecoin supply.

Prediction markets remain one of the most prominent crypto themes of 2025, with both market leaders Polymarket and Kalshi securing major funding rounds that value them in the billions. Notably, Polymarket’s funding came from a single source: the Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE).

The trend signals growing interest in event-driven trading platforms as a new frontier for both decentralised finance (DeFi) and regulated derivatives.

Of the two platforms, Polymarket has deeper ties with crypto, being partially built on Polygon (POL). Rumours continue to swirl surrounding whether Polymarket will release a token and reward early users with an airdrop.