What are Stablecoins?

8 minutes

8 minutes

8 minutes

8 minutes

One of the main things cryptocurrencies and stock are famous for is their volatility. It’s what many value due to the fact that an investment into them has the ability to go up and down depending on market conditions. However, while most coins rise and fall in value over time, ‘stablecoins’ (for the most part) remain just that: stable.

What makes stablecoins stable in nature is the fact that they are generally pegged against a fiat currency which doesn’t fluctuate as heavily as other asset classes. This means that stablecoins are designed to maintain a relatively constant value, usually equal to one unit of the fiat currency they are pegged against. By providing a sense of security and predictability, stablecoins aim to offer a more reliable store of value and a convenient medium of exchange within the cryptocurrency ecosystem.

Stablecoins are a type of cryptocurrency. They’re designed to maintain a stable value. The value of most stablecoins is pegged to a collateralising asset or basket of assets. Because of this peg, the price stability of stablecoins is far better than bitcoin and many other cryptocurrencies.

Stablecoins are typically not pegged to assets that experience high levels of volatility in market prices. Stablecoins exist to provide the same benefits as blockchain-based cryptos, yet without the associated volatility. They can also be used to send quick and cheap cross-border payments and as a store of value. Stablecoins achieve stability by being backed by reserves such as fiat currencies or precious metals. They aim to maintain a steady value, making them an attractive option for users who want to avoid the price fluctuations seen in other cryptocurrencies. However, it is important to note that while stablecoins may be relatively stable compared to other cryptocurrencies, they are not completely immune to volatility. External factors such as market conditions and the management of reserves can still impact their stability. Therefore, it is crucial for users to carefully assess the mechanisms and transparency behind each stablecoin to determine their level of stability.

Many governments are now proposing the use of stablecoins. Some recent examples include the Russian CryptoRuble, the Swiss e-Kroner, and the Estonian Estcoin. Stablecoins are playing an increasingly important role in the Internet of Tomorrow (IOT). Growing in popularity, stablecoins have the potential to become a critical part of the global financial system. As stablecoins gain traction, it becomes imperative for users to understand the underlying mechanisms and transparency of each stablecoin. Assessing these factors is crucial in determining the level of stability offered by each stablecoin. Governments worldwide are recognising the potential of stablecoins and are proposing their use. This growing popularity indicates that stablecoins have the potential to become an integral component of the future global financial system, especially in the context of the Internet of Things (IOT).

Stablecoins are ’collateralised’, this means that they obtain their value from being ‘pegged’ to another asset. You will find that there are three types of stablecoins, each linked to a separate class of asset. The first type is fiat collateralised stablecoins, which are backed by traditional currencies such as the US dollar or the euro. These stablecoins maintain stability by holding an equivalent amount of the underlying fiat currency in reserve. The second type is commodity collateralised stablecoins, which are tied to the value of physical assets like gold or oil. These stablecoins provide stability by ensuring that the value of the underlying asset remains relatively constant. The third type is algorithmic stablecoins, which use complex algorithms to maintain their value. These stablecoins adjust their supply based on market demand, with the aim of maintaining their value remains stable over time.

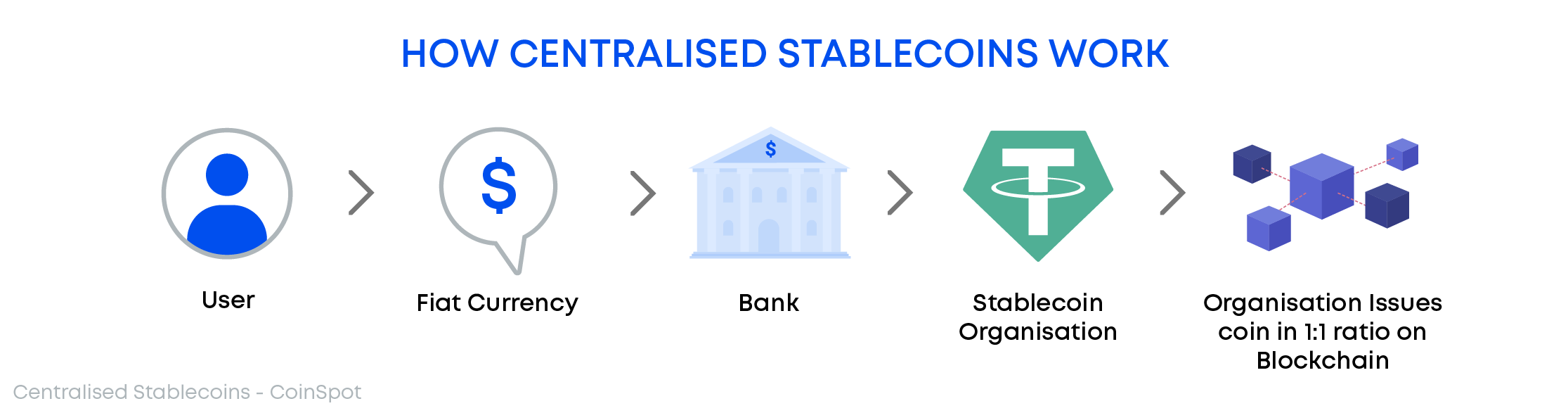

As the name suggests, these are tied to fiat currencies like the US dollar and are the most common type of stablecoin. Probably the most well-known stablecoin on the market is Tether, which is a fiat-pegged currency linked to the US Dollar. Fiat-pegged stablecoins are backed by reserves of the corresponding fiat currency, which means that for every unit of stablecoin in circulation, there is an equivalent amount of fiat currency held in reserve. This ensures that the stablecoin maintains a 1:1 parity with the fiat currency it is pegged to. Fiat-pegged stablecoins provide stability, making them a popular choice for users seeking stability in the volatile cryptocurrency market.

These coins simply represent deposits of cryptocurrency; in the case of crypto-pegged stablecoins, each deposit must remain more valuable than the value of the stablecoin in order to avoid losses. The value of crypto-pegged stablecoins is directly tied to the value of the underlying cryptocurrency. This means that if the value of the cryptocurrency drops significantly, the value of the stablecoin will also decrease, potentially resulting in losses for the holders. However, these stablecoins offer users the opportunity to participate in the cryptocurrency market while still maintaining some stability and avoiding the risks associated with holding pure cryptocurrencies. A good example of a crypto-pegged stablecoin is Bitcoin BEP2, or BTCB. BTCB is pegged to Bitcoin, and one BTCB will always equal one BTC.

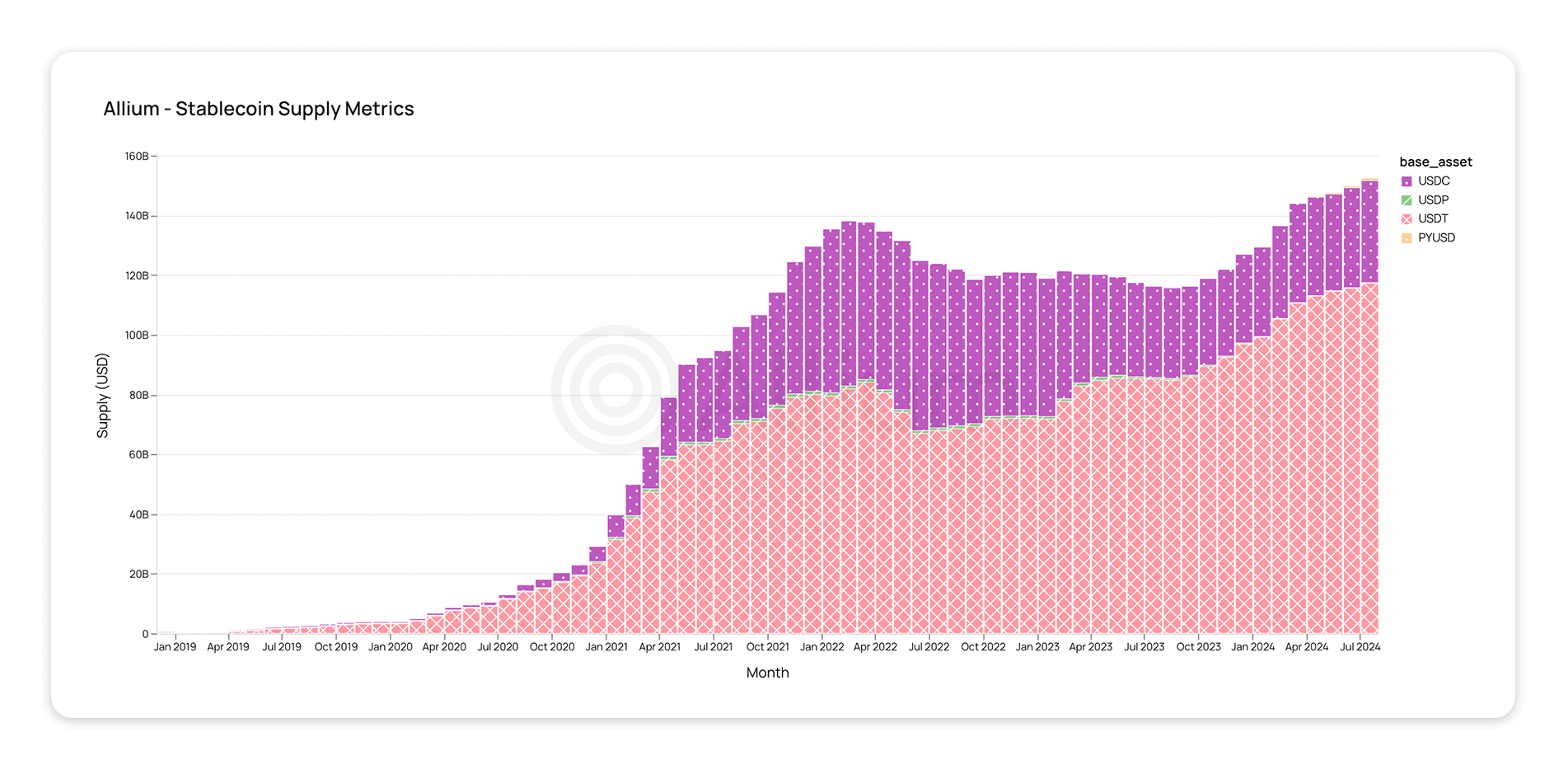

Safety exit for crypto investors: Stablecoin supply usually grows when the crypto market is performing poorly. That’s because many crypto investors use stablecoins as a safe harbour. When markets turn sour, they sell cryptocurrencies for stablecoins. This is usually cheaper and faster than selling into fiat.

Faster and cheaper remittance: Because stablecoins maintain parity, they’re better at functioning as a medium of exchange than other cryptocurrencies. Being built on blockchain technology means stablecoins are a lot faster and cheaper to send than a bank wire.

Stablecoins and dapps: Pairing smart contract technology with price-stable cryptocurrencies allows dapp developers to build better solutions. The DeFi space, for example, wouldn’t be where it is today had it not been for stablecoins.

Financial inclusivity: Censorship-resistant stablecoins can offer a much-needed alternative for those living in countries with bad monetary systems and tight capital controls.

Coinspot offers the ability to purchase a number of stablecoins; the list includes Tether, USD Coin, Reserve Rights, and Tribe.

Stablecoins are currently the most significant means by which money flows across the cryptocurrency ecosystem. They serve to provide a much-needed bridge between exchanges when fiat currencies cannot be directly transferred between them. They also provide a huge benefit for citizens of countries where the national currency itself experiences high levels of price volatility, often due to hyperinflation. By using stablecoins like Tether, USD Coin, Reserve Rights, and Tribe, individuals in these countries can protect their wealth from rapid devaluation. Moreover, stablecoins offer a level of stability and reliability that other cryptocurrencies lack, making them an attractive option for investors. As the popularity of stablecoins continues to grow, it is expected that more innovative use cases and applications will arise, further solidifying their role in the cryptocurrency ecosystem.

All of the above stablecoins can quickly and securely be traded on Australia’s most trusted exchange, CoinSpot. If you haven’t already registered for a CoinSpot account, you can do so for free here.

10 minutes

10 minutes